I get asked this a lot, usually by people who've heard the CFA is "the gold standard in finance" and are wondering if they should jump in. My honest answer is: it depends entirely on what you want to do.

The CFA is an incredible credential for certain career paths. For others, it's hundreds of hours spent on something that won't move the needle much. So before you register, it's worth thinking about a few things.

What do you actually want to do with your career?

The CFA is most useful in investment management, equity research, portfolio management, risk, and some areas of corporate finance. If you want to work in these fields, it's almost a must-have in many markets. Hiring managers notice it. Clients trust it. It signals that you know your stuff and you can commit to something difficult over a long period.

But if you're aiming for investment banking, consulting, or startups, an MBA or other credentials might be a better use of your time. Those industries care more about the network and brand of your business school than whether you can calculate modified duration in your sleep.

I work in wealth management, so the CFA made obvious sense for me. But I've got friends in tech and consulting who would get almost nothing from it. Know your industry before you commit.

Can you handle a multi-year commitment?

Three levels. Each one takes months of preparation. Most people take three to four years to finish the whole thing, and that's if everything goes smoothly. Some take longer. Failed attempts, life getting in the way, burnout. It happens.

You need to be genuinely okay with that timeline. If you're looking for something quick to add to your LinkedIn, this isn't it. The CFA rewards patience and consistency more than anything else. I'm still early in the process myself, and I can already tell this is going to test my discipline in ways I didn't fully expect.

Do you actually find this stuff interesting?

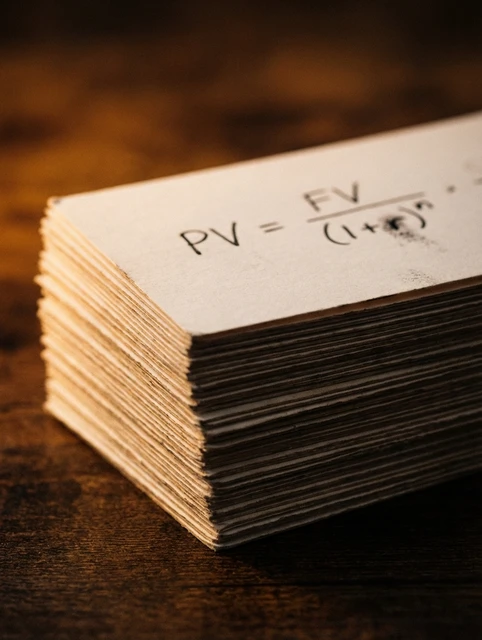

I don't mean this as a throwaway question. The CFA curriculum covers fixed income, derivatives, alternative investments, ethics, financial reporting, and a lot more. You're going to spend hundreds of hours with this material. If reading about bond duration and modified Dietz returns makes you want to close your laptop, you're going to have a rough time.

I genuinely enjoy most of the material, and even I have topics that make me want to stare at a wall. If you're doing this purely for the letters after your name, the motivation tends to run out somewhere around Level II. That's when the content gets significantly harder, and you need real curiosity to push through the tough sections.

When the CFA makes sense

- You're building a career in investment management, research, or wealth management

- You want a credential that's respected globally and signals serious commitment

- You find financial markets and analysis genuinely interesting

- You're prepared to study consistently over multiple years

When it probably doesn't

- Your career path doesn't really value or require the CFA

- You're mainly doing it because someone told you to

- The subject matter doesn't excite you at all

- You're not in a position to give it the time it needs right now

The CFA has been worth it for me so far. It's deepened how I think about markets and investing, and it carries weight in my industry. But I'd never tell someone to do it just because it sounds prestigious. Make sure your reasons are solid before you commit.