One of the biggest mistakes I made early on was spending more time planning my study schedule than actually studying. I had a colour-coded spreadsheet, a Notion tracker, the works. And then real life happened. I missed two days, the whole thing fell apart, and I felt behind before I'd really started.

What I use now is much simpler. It's not fancy, but it's survived six-day work weeks, gym sessions, and the occasional weekend where I just needed to do absolutely nothing.

Start from the exam date and work backwards

Figure out how many weeks you have. Take away three or four weeks at the end for revision and mock exams. Whatever's left is your study window. That's it. That's your starting point.

I spread the curriculum topics across those weeks, giving more time to the heavy hitters like Financial Reporting and Analysis, Equity, and Fixed Income. It doesn't need to be precise down to the day. A rough weekly plan is enough. Monday through Friday I'll focus on one sub-topic. Weekends I'll review or catch up. Simple.

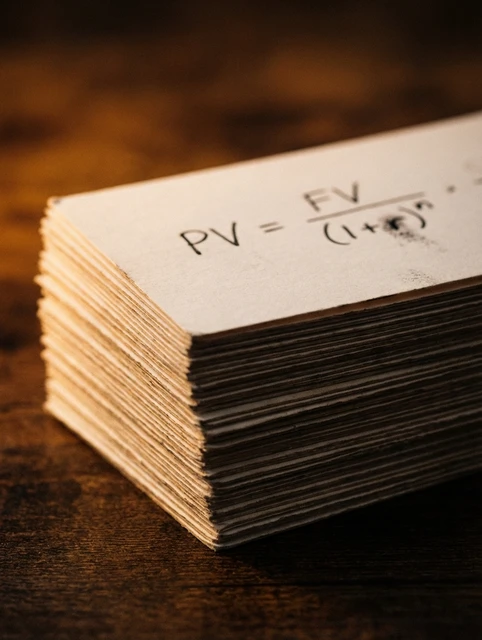

Not all topics deserve the same time

FRA, Ethics, and Equity tend to carry the most weight on the exam. I spend more time on these and less on topics like Alternative Investments or Corporate Issuers (though you can't skip them entirely). It's about prioritising, not ignoring.

I made the mistake of giving every topic equal time at first and ended up underprepared in the areas that actually dominate the exam. A friend who'd already passed told me to weight my study time based on exam weight. Obvious advice in hindsight, but it made a big difference once I actually did it.

Do questions from day one

This was probably the biggest shift for me. I used to read all the notes first and save practice questions for the end. Bad idea. Now I do questions after every topic, sometimes even halfway through a reading.

Reading notes gives you familiarity. Doing questions is where you actually learn what you know and what you don't. There's a big gap between recognising a concept on the page and being able to apply it when a question frames it differently. The sooner you start doing questions, the sooner you figure out your weak spots.

Mock exams are non-negotiable

I block out three or four Sundays in the final month for full mock exams. Timed, no phone, no breaks beyond what the real exam allows. It's not fun, but your mock scores are the most honest feedback you'll get.

They also help you build the stamina for sitting through the actual exam, which is longer and more draining than most people expect. The first mock I did, I was mentally exhausted by the halfway point. By the third one, I could push through the whole thing without losing focus. That kind of endurance only comes from practice.

Build in buffer days

Things will come up. Work deadlines, family stuff, days where you're just exhausted from the gym and a full week at the office. If your plan has zero flexibility, one bad week and you feel like you've failed already.

I leave at least one or two "catch up" days per week where I have nothing scheduled. Sometimes I use them to study. Sometimes I use them to rest. Both are fine. The point is that missing a day doesn't derail everything.

My study plan fits on a single page. It's got weekly topic targets, a few mock exam dates blocked out, and some room to breathe. That's it. I don't track hours and I don't beat myself up if I miss a day. I just make sure the overall trend is moving forward. If it works for someone juggling a six-day work week, the gym, and a content page, it can probably work for you too.